Alerts

FTC releases 2024 Hart-Scott-Rodino Act filing thresholds and filing fees

January 25, 2024

On January 22, 2024, the Federal Trade Commission (FTC) published its updated thresholds for pre-merger notifications under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act). The HSR Act requires parties in transactions meeting certain thresholds to notify the FTC and the Antitrust Division of the U.S. Department of Justice of such transaction prior to its closing. The thresholds are updated annually to account for changes in the gross national product. The new thresholds will take effect 30 days after publication in the Federal Register, which is expected to be in late February, and apply to transactions that close on or after that date.

Size-of-Transaction Threshold: The “size-of-transaction” threshold for reportable acquisitions of voting securities, non-corporate interests or assets will increase from $111.4 million to $119.5 million.

Size-of-Person Thresholds: Transactions with a value of greater than $119.5 million, but less than $478 million, up from $445.5 million, are reportable only if the “size-of-person” threshold is also met, absent an exemption. The size-of-person threshold is met if one party to the transaction has annual net sales or total assets of at least $239 million, up from $222.7 million, and the other party has annual net sales or total assets of at least $23.9 million, up from $22.3 million.

Transactions valued at more than $478 million, up from $445.5 million, are reportable regardless of the size of the parties, absent an exemption. The size-of-person test will not apply to transactions of such value.

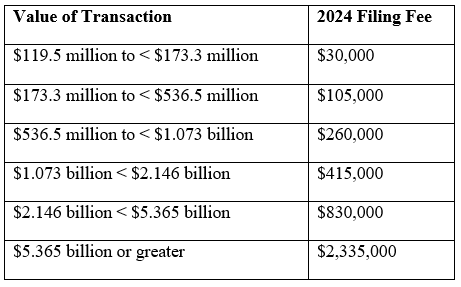

Filing Fees: The updated HSR filing fees are as follows:

Penalties: Determining whether an HSR notification must be filed often requires a complex analysis of the transaction, transaction parties and the HSR Act. Earlier this year, the FTC announced an annual increase to the maximum civil penalty amount for HSR violations. Failure to comply with the HSR Act can result in penalties in the amount of $51,744 per day, up from $50,120 per day.

If you have questions or concerns about the HSR Act or notification obligations for a transaction, the experienced and knowledgeable corporate attorneys at Chuhak & Tecson are available to assist you.

Client alert authored by Margaret M. Salinas (312.855.6126), principal.

This Chuhak & Tecson, P.C. communication is intended only to provide information regarding developments in the law and information of general interest. It is not intended to constitute advice regarding legal problems and should not be relied upon as such.